The Practical Path to AI-Powered CRE Firms: Vertical AI Agents

Head of Real Estate Practice

Why Vertical AI Agents in CRE Must Move from Insights to Execution

The commercial real estate industry is increasingly embracing artificial intelligence, but most implementations remain limited to predictive analytics and insights. To bridge the gap between insights and execution, firms must adopt Vertical AI Agents—specialized AI systems designed to automate underwriting, leasing, and asset management workflows. While these tools help firms increase efficiency and make more informed decisions, they do not automate execution, leaving critical workflows like underwriting, leasing, asset management, and financial reconciliation highly manual, fragmented, and inefficient.

The next phase of AI in CRE is not another SaaS platform or analytics dashboard. It is vertical AI agents: specialized AI systems designed specifically for real estate investment, brokerage, and asset management workflows.

AI agents do not just analyze data. They act on it.

Firms that deploy AI agents today will build an operational advantage that compounds over time, automating complex workflows while competitors remain dependent on Excel, email, and slow human-driven processes.

Why Vertical AI Agents Will Redefine CRE Operations

The Problem: AI Adoption in CRE is Stalled at Prediction, Not Execution

Most AI implementations in CRE today remain focused on passive analysis.

- Underwriting platforms suggest pricing models but do not dynamically adjust them in real time.

- Market intelligence tools generate comps, but investment teams still manually compare deals.

- Lease abstraction tools extract data, but leasing teams still manually re-structure and update terms.

- Predictive maintenance flags potential issues, but property managers still have to initiate repairs.

The real bottleneck is not generating AI-driven insights but acting on them at scale.

The Solution: AI Agents That Execute, Not Just Analyze

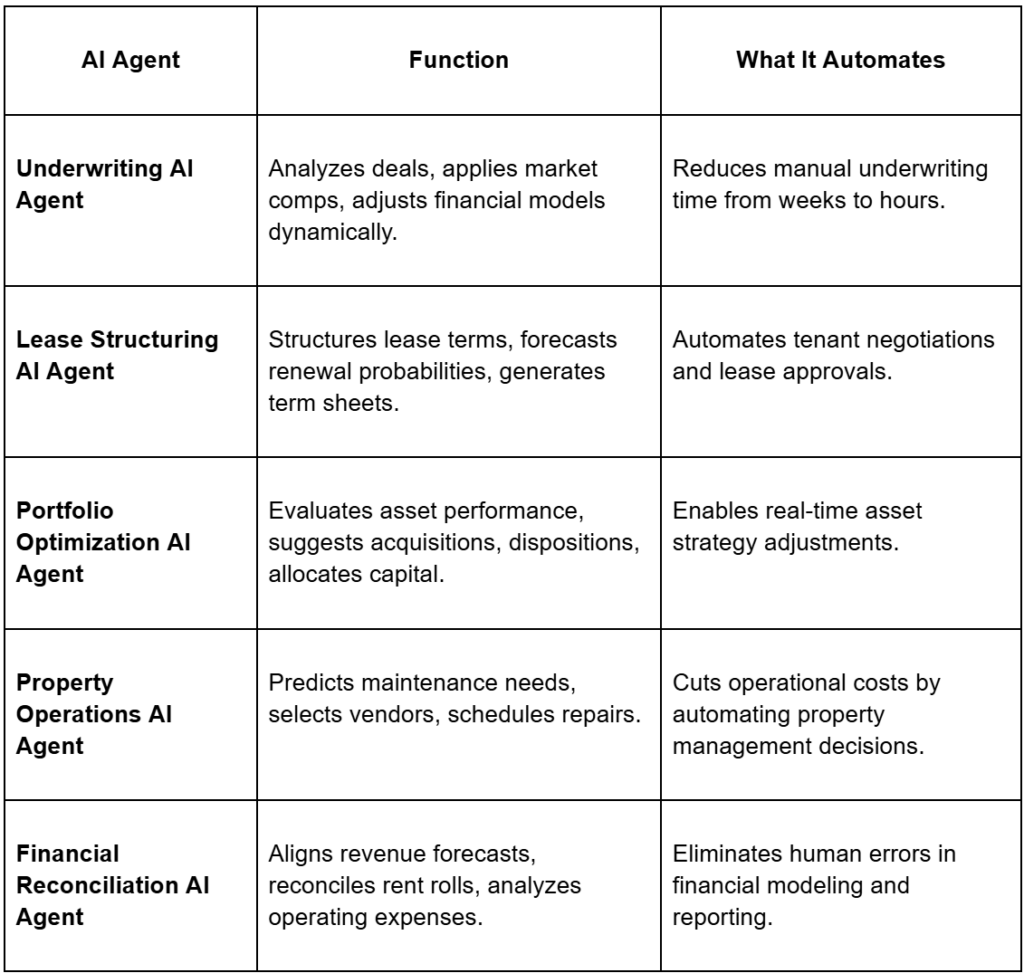

Unlike general-purpose AI models, vertical AI agents are purpose-built for the nuances of commercial real estate operations. These agents do not simply assist—they automate execution, integrating directly into leasing, asset management, underwriting, and finance workflows.

Individually, each AI agent removes friction from a specific workflow. Together, they create a fully autonomous CRE decision-making system—one where AI not only provides insights but can act on them in real time.

The Financial and Competitive Impact of AI Execution in CRE

For AI adoption to accelerate in CRE, executives need a clear business case with measurable return on investment. Firms that have already implemented AI execution are seeing:

- Up to ten percent net operating income growth by automating lease pricing and asset allocation (Deloitte, “Generative AI in Real Estate”).

- Thirty percent reduction in administrative workload in property management, freeing up time for higher-value activities (JLL, “AI in Real Estate”).

- Twenty percent decrease in maintenance costs through predictive automation (McKinsey, “AI-Driven Property Operations”).

- Forty percent faster deal execution by eliminating data bottlenecks in underwriting and due diligence (EY, “GenAI is transforming what’s possible in CRE”)

These are not theoretical projections. Firms that have deployed AI agents in underwriting, leasing, and asset management are already seeing measurable results.

The Competitive Reality: AI is a 2025 Imperative

The CRE firms leading AI adoption today are not asking if AI will change their industry—they are asking how fast they can implement it.

- Institutional investors are using AI to predict property appreciation and rent trends more accurately.

- Global brokerages are deploying AI-powered deal sourcing to find off-market opportunities before competitors.

- REITs are using AI agents to automate lease structuring, reducing turnover rates and boosting retention.

The firms that move now will own the AI-driven CRE market, while those that hesitate will struggle to keep pace in an increasingly automated industry.

How CRE Firms Can Deploy AI Agents Today

A Step-by-Step Approach to AI Execution

- Conduct an AI Readiness Assessment

- Identify which manual workflows create the biggest inefficiencies.

- Evaluate data quality to ensure AI compatibility.

- Assess integration potential with existing CRM, underwriting, and leasing platforms.

- Start with a Targeted AI Pilot

- Deploy one AI agent (e.g., underwriting automation or lease optimization).

- Run a Proof of Concept pilot to measure time savings, accuracy improvements, and financial impact.

- Optimize AI agent performance before scaling across departments.

- Establish AI Governance & Risk Management

- Implement real-time monitoring for AI accuracy and compliance.

- Develop a regulatory framework to ensure AI aligns with industry standards.

- Train teams on how to validate and interpret AI-driven decisions effectively.

- Integrate AI Across Existing Systems

- Ensure AI connects seamlessly with Yardi, MRI, VTS, Argus, CoStar, and Salesforce.

- Automate data flows between AI agents and legacy platforms to eliminate inefficiencies.

- Develop APIs for cross-platform intelligence, ensuring AI-generated insights drive real-time execution.

- Scale AI Execution Across the Organization

- Expand AI agent capabilities to leasing, finance, and asset management teams.

- Move beyond AI-assisted insights to full AI-powered decision execution.

- Continuously iterate and refine AI models based on business needs.

The firms that deploy AI agents now will be the first to achieve fully autonomous CRE operations.

Why First Line Software?

The most successful AI implementations are led by firms with deep expertise in both AI development and commercial real estate workflows.

- Proven AI Deployment in CRE – First Line Software specializes in AI solutions that integrate seamlessly into real estate investment, brokerage, and asset management workflows.

- Seamless Integration with Existing Platforms – AI agents connect with Yardi, MRI, VTS, Argus, CoStar, Salesforce, and other core CRE systems.

- Scalable, Modular AI Agents – Firms can start with one high-impact AI agent and scale execution over time.

- AI Ethics, Compliance, and Security – AI solutions are designed to be transparent, auditable, and compliant with industry standards.

The Future of AI in CRE: Execution, Not Just Insights

The next wave of AI in CRE will move beyond predictive analytics to automated decision execution. AI agents will assist in lease negotiations, underwriting, asset management, and operations autonomously. Firms that embrace AI execution now will lead the industry in efficiency, profitability, and scale.

Delaying AI adoption is no longer an option.

At First Line Software, we are building the AI backbone for real estate firms—a modular, scalable AI agent system that integrates into existing workflows to drive execution, not just insights.

For firms looking to move beyond AI pilots and automate real estate decision-making, now is the time to take action. Contact us to learn more about how AI agents can be deployed in your organization.